Its that time of the year again! Winter!

Preparing Ontario home for the winter can be daunting. Starting early before snowfall and taking time between jobs will make it much more manageable.

Winter preparation keeps you out of the cold, keeps money in your pocket through energy savings and keeps your home running efficiently.

Below are 6 ways to winterize your Ontario home;

1. Maintain machines and appliances

Having your furnace and ventilation system serviced by a professional in the fall can prevent potential emergency calls when the temperature drops.

For improved air quality throughout your home, have your ducts cleaned annually before the onset of cold weather. Outdoor air conditioning units should be covered properly and their power disconnected during the off-season. While you’re at it, cover any lawn furniture or landscaping that will be exposed to the elements.

Conduct a thorough inspection on your yard tools too – drain fuel from your lawn mower and water from your pressure washer, and complete a maintenance check on your snowblower. This will prolong their lifespan and ensure they work efficiently when you need them. If you heat your home with wood, oil or propane, be sure to top up your supply before the cold months hit.

2. Seal windows, doors, decks and concrete

If the caulking or weather stripping around your windows and doors is cracked, it can let cold air and moisture in, damaging window sills while causing mildew, mold and significant heat loss. Repair and replace what is necessary and cover older windows with a protective window film until they can be replaced.

Decks, driveways and concrete surfaces are not impermeable. Purchase proper sealants or stains that you can apply yourself before ice and snow arrives, or hire a professional. Preserving the integrity of these large surfaces will only serve you in the long run, saving you from major repairs or full replacements.

3. Outside water

Before draining your pipes, disconnecting hoses or winterizing your sprinkler system, always turn off the outside water supply. Leaving the outside water on during winter can cause pipes to burst, leading to flooding and damage to your property. If you haven’t already, you may want to consider insulating your water pipes, especially if you leave a summer home unattended off-season or vacation for extended periods of time in the winter months.

4. Check your gutters

Make sure the gutters are in good condition and properly secured to your home. Prevent damage by clearing out debris to allow snow to melt and drain easily, and point the downspout away from your home. Water should always be moving away from your property to avoid flooding and water damage.

Gutter guards are a worthy investment, as they can help to keep debris and pests out. Clogged gutters can result in leaks that lead to mold and mildew, and act as a breeding ground for mosquitoes and bacteria.

5. Tend to the attic

Pests can cause damage to your home and your health. Safeguard your attic from birds and rodents who may move in during the winter by checking for access points and placing a screen under any vent. Contact pest control if you suspect an infestation.

To keep warm air from escaping through your roof, determine the R-Value of your current attic insulation and add more to areas not properly insulated, or completely replace the insulation if needed. For added warmth and energy efficiency, you can add insulation to your garage doors and basement.

6. Inspect your smoke detectors

This important task is not limited to just one season… Inspect your smoke and carbon monoxide detectors monthly, replacing batteries and cleaning them when necessary. Smart home devices can be installed to continuously monitor smoke detectors (and much more), providing added peace of mind.

If some of these tasks are not within your skillset or you simply don’t have the time, hire a general contractor for the small jobs and a certified technician for specialized tasks, such as inspecting the furnace.

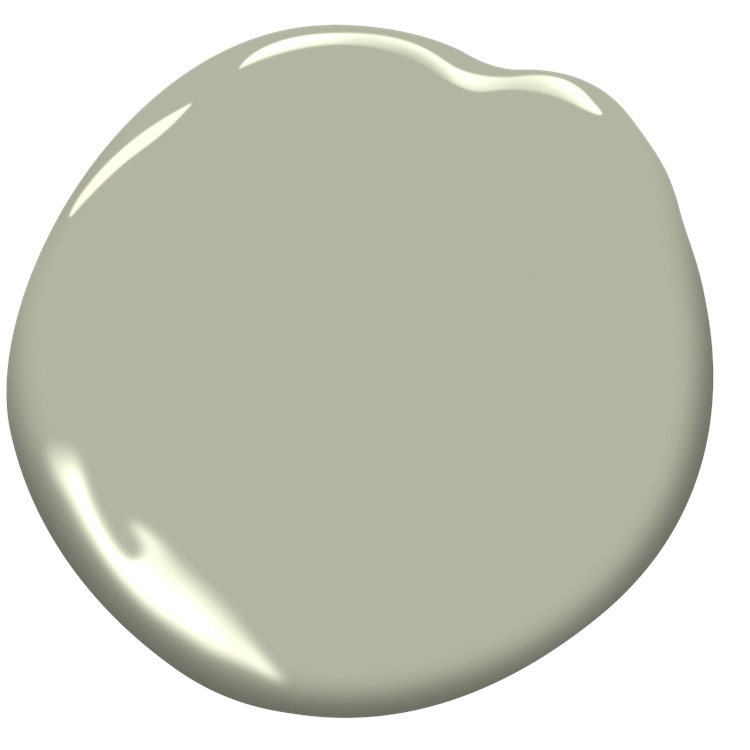

October Mist, Benjamin Moore

October Mist, Benjamin Moore Evergreen Fog, Sherwin Williams

Evergreen Fog, Sherwin Williams