Selling your home in Toronto, Aurora, Newmarket, Richmond Hill, King City, or Simcoe is an exciting journey. However, preparing it for the market is key to attracting buyers and securing top dollar. Follow these essential steps to ensure your home is ready to shine!

1. Declutter & Depersonalize

Buyers need to envision themselves living in your space. Remove personal items, excess furniture, and anything that makes the home feel cluttered. A clean, neutral space creates a welcoming atmosphere.

2. Deep Clean Every Corner

A spotless home leaves a lasting impression. Pay extra attention to kitchens, bathrooms, and floors. Consider professional cleaning services to ensure a pristine look.

3. Make Necessary Repairs

Fix leaky faucets, squeaky doors, chipped paint, and any other minor issues. Small repairs can make a big difference in how your home is perceived.

4. Enhance Curb Appeal

First impressions matter! Mow the lawn, trim bushes, plant flowers, and power wash the driveway. A well-maintained exterior sets the tone for what’s inside.

5. Stage for Success

Staging helps highlight your home’s best features. Arrange furniture to maximize space and light, add fresh flowers, and use neutral decor to appeal to a wide range of buyers.

6. Brighten Up the Space

Let in natural light by opening curtains and blinds. Replace dim or outdated light fixtures with bright, modern options to create a warm and inviting feel.

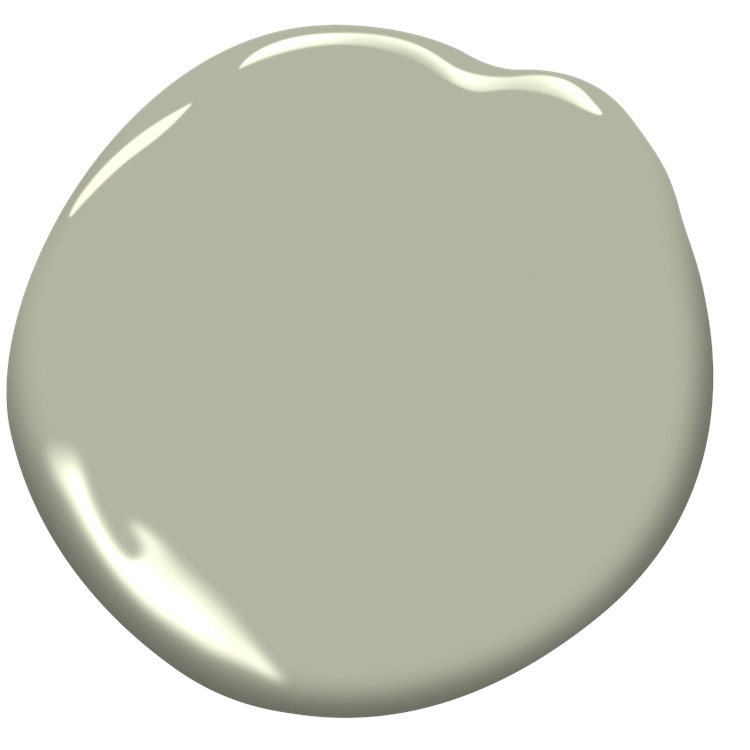

7. Neutralize Paint Colors

Bold colours may not suit every buyer’s taste. A fresh coat of neutral paint makes rooms look bigger and more inviting.

8. Create a Welcoming Scent

Unpleasant odours can turn buyers away. Open windows for fresh air, use subtle air fresheners and bake something light like cookies before showings.

9. Take High-Quality Photos

Most buyers start their search online, so stunning listing photos are crucial. Hire a professional photographer or use natural light to capture your home’s best angles.

10. Work with a Real Estate Professional

An experienced real estate agent specializing in Toronto, Aurora, Newmarket, Richmond Hill, King City, and Simcoe will provide expert guidance, market your home effectively, and negotiate the best deal. Partnering with the right listing agent ensures a smooth and successful sale.

Ready to List? Let’s Talk! Are you thinking about selling? I’m here to help you navigate the process and get the best results. Contact me today for a free consultation and expert real estate advice in Toronto, Aurora, Newmarket, Richmond Hill, King City, Markham, Simcoe and the surrounding area!

October Mist, Benjamin Moore

October Mist, Benjamin Moore Evergreen Fog, Sherwin Williams

Evergreen Fog, Sherwin Williams